As a parent, you understand that the end of the year is about more than holiday parties, treats, and gifts. It’s also a time to look to the coming year and make plans for your family’s overall well-being. When making goals or resolutions, chances are the health and financial stability of your family are top of mind. While you may be resolving to eat more healthfully or increase your kids’ physical activity to set them up for a happy and healthy future, you may be missing the most vital piece of the overall health picture: health insurance.

Adequate health insurance coverage will have a dramatic impact on the physical and financial health and well-being of your family. But this requires action and planning now—not on January 1 like most resolutions. Open Enrollment for individual health coverage began on November 15 and runs through midnight on December 15, 2018 for coverage that begins January 1, 2019.

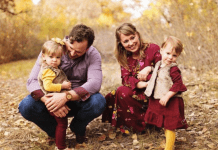

Having proper health insurance not only protects your family; it gives you peace of mind.

Having proper health insurance not only protects your family; it gives you peace of mind.

No one plans to get sick or hurt, but health problems can come up very unexpectedly. For school-age children, illnesses can spread quickly throughout classrooms. Sports injuries and broken bones often result from active and adventurous kids and cannot be planned for. And whatever stage of life your children are in, accidents and illnesses can strike without warning. Whether it’s a broken bone, appendicitis, a sports injury, a car accident, or a serious health diagnosis, you could be stuck with staggering medical bills if you do not have adequate coverage. For example, an emergency room visit to set a broken leg can cost more than $10,000!

Health insurance protects your family from unexpected, high medical costs. It also gives you access to many no-cost preventive care services for essential health benefits that help you stay healthy throughout the year.

But it isn’t enough to have insurance; it is just as important to choose the right plan that provides the best possible coverage and care for your children.

When selecting a plan, think about how much you spend each year on healthcare. How often do you see your doctor? Do you or your kids have a chronic condition like asthma or diabetes that requires frequent doctor visits? Does anyone in your family take prescription medications on a regular basis? You may find that the plan with the lowest premium may not be the most cost-effective one.

A health plan’s network of doctors is also important. If you have a beloved family pediatrician or primary care doctor, make sure they are in the network. You’ll save money by going to in-network providers.

Understand the details of the plan you are considering. Look at the copays, coinsurance, and deductibles the plan offers and what you will be required to pay out-of-pocket. If you have to pay high copays and coinsurance or meet a high deductible before coverage begins, a less-expensive plan may end up costing you more throughout the year.

Understand the details of the plan you are considering. Look at the copays, coinsurance, and deductibles the plan offers and what you will be required to pay out-of-pocket. If you have to pay high copays and coinsurance or meet a high deductible before coverage begins, a less-expensive plan may end up costing you more throughout the year.

You have many options to consider in ensuring you have the best health coverage for your family’s unique needs. We urge all New Mexicans to consider their options, make educated decisions to protect the health of their families, and to be sure to select coverage during the Open Enrollment period. If you are having trouble figuring out your options, the New Mexico Health Connections team can answer your questions and help to select the right coverage options for every member of your family.

For more information, go to mynmhc.org or call us at (505) 322-2360 Monday through Friday, 8:00 a.m. to 5:00 p.m.

About our Guest Blogger

Marlene Baca serves as the Chief Executive Officer for New Mexico Health Connections, a nonprofit, consumer-oriented and operated health plan (CO-OP) that provides health insurance coverage to individuals and families both on and off the health insurance exchange. She is the mother of two daughters, and has a 7-year-old grandson and a 4-year-old granddaughter. Marlene has owned and operated Baca Consulting Firm, which provides strategic and marketing guidance to healthcare and health plans in New Mexico and Texas since 2016. Prior to that, Ms. Baca served Lovelace Health Plan in many capacities, including Chief Programs Officer, Chief Sales and Service Officer, and Vice President of Public Programs. She has more than 30 years of experience in the healthcare industry and an equally strong history of serving her community.