2018 is a great time to be alive. The number of innovations, conveniences, and opportunities available astounds me sometimes. I mean, c’mon, we live in the era of dry shampoo and drive-thru coffee shops. Not to mention we have the option to wear yoga pants unlike our corset-wearing sisters of yore.

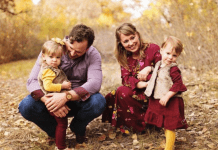

Another beautiful addition to our lives has been the ability for so many of us to work from home or start our own businesses from home. While these options are not feasible for everyone, there’s a reason why “momprenuer” and “mom boss” are now part of our vernacular. They’re a thing! These opportunities allow parents more freedom with their families while still earning an income. No, to a time clock to punch. Yes, to a paycheck. Win win!

However, there’s more to being a momprenuer than selling our favorite leggings or being the best virtual assistant ever. We can’t forget about the ol’ government when we decide to venture out on our own as business owners.

However, there’s more to being a momprenuer than selling our favorite leggings or being the best virtual assistant ever. We can’t forget about the ol’ government when we decide to venture out on our own as business owners.

And that’s where my girl Lauren from Essential CPA Solutions comes in handy. You see, I’m a business owner. (High five, fellow business owners!) And I have some pretty great ideas, if I do say so myself. I can sell all the stuff and connect all the people and plan all the events. But if you ask me what gross receipts tax or quarterly estimated taxes are, my armpits start sweating. At this point, I gotta pull in the financial experts. There are four big reasons I have a CPA.

1. My CPA allows me to focus on what I’m best at.

Business owners, you’re not dummies. I’m sure you could spend hours and hours and hours to figure out all the tax things and all the record keeping things. But all those hours take away from the main focus of your business.

Those are hours you cannot do the things that you are good at. Nor can you do what you love. And guess what else you can’t do when you’re learning good accounting practices? You can’t make money.

An important leadership principle I’ve learned the hard way is to only do what I can do. Everything else I try to hire out. There are certain aspects of a business that only the owner of a business can do. Do those things, and that’s it! Any time I’ve violated this principle, I’ve hindered the progress and growth of my business.

2. My CPA is a financial expert. And I am not.

2. My CPA is a financial expert. And I am not.

Lauren Stover of Essential CPA Solutions knows her stuff. She knows when tax laws change. She understands hard words. (I’m sorry, but who came up the phrase “Gross Receipts Tax.” It is just so intimidating.) She knows when the things are due to the tax people. She knows what’s deductible and what’s not. (In case you were wondering, pedicures are not deductible. I checked.) She has simple tricks to help you with record keeping. Here’s one. Take photos of receipts instead of saving every little piece of paper. Inset praise hands emoji here.

3. My CPA is a woman and a mother who owns her own local business too!

The word “accountant” conjures up images of a stuffy men wearing wide ties (not the cool kind) in a florescent lit, non-descript office building. No, just no.

If I know I need a CPA and I’m better with one, why wouldn’t I choose one who’s also living the #momlife and has the entrepreneurial spirit herself? I don’t want to hire a big box company or give my dollars to gigantic tax chains (why are these in every shopping plaza?) if I can work with a local business woman right here in my community who’s supporting her family.

4. Accounting services at Essential CPA Solutions are more affordable than I thought they would be.

Honestly, before I met with some accountants, I had no idea how much professional accounting actually costs. Much to my surprise, the costs were much more affordable than I thought they’d be, at least they were at Essential CPA Solutions. So it certainly can’t hurt to look into it.

I imagine some of you may push back and say that you cannot afford to hire a CPA. I would push back on your push back and say that you can’t afford not to. In the long run, I think you’ll see that you actually make more money. Because you have a financial expert on your side, you are freed up to grow your business!

Essential CPA Solutions offers monthly or quarterly bookkeeping, tax preparation and planning, bank reconciliations, pay roll reporting, and assistance with notices from the tax authorities. Best of all, there are no stupid financial questions at Essential CPA Solutions. And initial 30-minute consultations are free.

Note, we are currently inviting direct sales consultants to be part of our 2018 Guide to Consultant-Run Businesses. If you’re interested in being a part of this guide, please email us for more information.